fdfdfsdfsd

Contents:

As shown on the chart above, something happens when the RVI and signal line of the RVI indicator make a crossover. The red arrows show how the pair moves upwards when the two indicators cross over. The blue lines, instead, shows how the price moves lower when the two lines make a crossover.

- RVI belongs to the broad Oscillator group of indicators, which essentially means that it helps traders to determine overbought and oversold conditions in the market.

- Risk capital is money that can be lost without jeopardizing ones’ financial security or life style.

- However, you can always evaluate the work of the indicator with another setting historically and choose optimal settings for your strategy.

- The presence of divergences is usually a precursor to the reversal of a trend and serves as a signal for price exhaustion in the market.

- You should then calculate the simple moving averages for the numerator and denominator for the period.

The “https://forexhero.info/ ”, or “RVI”, is a popular member of the Oscillator family of technical indicators. Traders generally expect the RVI to signal direction shifts and to increase in Bullish markets when momentum is on the rise and closing prices exceed opening values. Fluctuations tend to be smoother such that divergences between the index and price behaviour have more meaning. These are the main types of signals RVI traders seek in the market. Depending on the parameters set, RVI will signal traders when there are potential overbought or oversold conditions in the market. Usually, a reading closer to 0.4 will imply overbought conditions, whereas a reading close to -0.4 will imply oversold conditions.

Compared to other indicators, the Relative Vigor Index is produced by a rather complicated set of steps. Fortunately, these steps lend themselves to basic programming language, such that your trading platform software can perform the calculations instantly. The indicator is typically displayed at the bottom of the chart, and occasionally, the weighted moving average is omitted. Trading keys evolve around crossovers of the midline and divergences from the price behaviour of the asset being followed. The indicator is also smoothed with a signal line, e.g. a moving average is calculated. Moving Average Convergence Divergence and RVI look alike and using these tools can help you to remove false signals of each indicator in your trading strategy.

How To Use Relative Vigor Index for Forex Trading?

By making use of this simple principle, the RVI indicator gives clear signals of when to trade, through its use of a signal line. A signal to buy on the indicator is only looked for if prices are above the MA, and to sell when the price is below the MA. When filtering with Japanese candlesticks or chart patterns, after receiving the indicator signal, the trader should find a chart pattern in the same direction. The entry is carried out according to the figure, and the exit is carried out with the opposite signal of the indicator and the figure in the opposite direction. When filtering using other indicators, you need to get an entry signal from at least 2 out of 3 indicators. RVI and two moving averages can confirm trend reversals when one crosses the other upwards or downwards based on the preceding trend.

Since the third rule arises from the second, unfortunately, this one cannot be used for our purposes. The only rule that can be used for us in this instance is RVI divergence. Noting that we are discussing trading the RVI alone rather than in combination with other analysis which would be imperative if looking to fitler false signals.

A rising RVI in an uptrend market can indicate that the trend will likely continue, while a falling RVI in a downtrend market can indicate that the trend will likely continue to fall. Below are a few more ways Relative Vigor Index Indicator improves efficiency in forex trading. More than a broker, Admirals is a financial hub, offering a wide range of financial products and services. We make it possible to approach personal finance through an all-in-one solution for investing, spending, and managing money. Though MetaTrader 4 comes with a standard set of popular indicators, you might like to expand the selection available to you by downloading MetaTrader Supreme Edition. MTSE is a custom plugin developed by market professionals that vastly extends the functionality of MetaTrader 4 and MetaTrader 5.

My goal in life is to share my knowledge and experience with more people. The second step is smoothing the RVI value using moving averages. There are hundreds of indicators in the TradingView account by default, but most traders always pick out certain favorites and mention only them. Another relatively simple way of using the RVI indicator is to trade divergences. This refers to a situation where the price of an asset is rising while that of the indicator is falling.

Note that the indicator doesn’t offer exact levels for overbought and oversold areas, so traders need to figure this out themselves. It addition, it’s necessary to remember that oscillators can remain at extreme levels over a prolonged period of time. RVI can be used in conjunction with the RSI to confirm overbought and oversold conditions and generate trading signals. For example, if the RVI is above 70 and the RSI is above 70, it could be a signal to enter a short position. RVI can be used in conjunction with the Stochastic Oscillator to confirm overbought and oversold conditions and generate trading signals. For example, if the RVI is above 70 and the Stochastic Oscillator is above 80, it could be a signal to enter a short position.

Price analysis 2/10: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, AVAX — Cointelegraph

Price analysis 2/10: BTC, ETH, BNB, XRP, ADA, DOGE, MATIC, DOT, LTC, AVAX.

Posted: Fri, 10 Feb 2023 08:00:00 GMT [source]

We are going to backtest our strategy by investing a hundred thousand USD into our trading strategy. So first, we are storing the amount of investment into the ‘investment_value’ variable. After that, we are calculating the number of Apple stocks we can buy using the investment amount. The number of stocks should be an integer but not a decimal number. Remember that the ‘floor’ function is way more complex than the ‘round’ function.

Larry Connors’ Double 7 Trading Strategy

The RVI indicator is based on an idea that the price action has a tendency to close higher compared to the opening prices in an uptrend, and have lower closing prices than opening in a downtrend. The Relative Vigor Index is based on the likelihood of prices closing higher than the open in market uptrends, and similarly, closing lower than the open in downtrends. The Relative Vigor Index compares the closing price of a security or asset to its trading range. The relative vigor index indicator is flexible to differing market conditions, thus can be used as part of a forex trend trading strategy and forex range trading strategy.

Genetic diversity and local adaption of alfalfa populations (Medicago … — Nature.com

Genetic diversity and local adaption of alfalfa populations (Medicago ….

Posted: Mon, 30 Jan 2023 08:00:00 GMT [source]

In other words, at its core, this indicator tries to gauge whether a market is bullish or bearish in character. The signal to sell emerges when the quick RVI line crosses the slow signal line from above in the overbought area. After the reversal is confirmed on the price chart, open a selling position with the SL behind the local high. Both divergences predicted that prices would fall, i.e., follow the RVI downward divergence.

It measures the strength of a trend by comparing the closing price of a security with its trading range and smoothing the results using a simple moving average . Divergences occur in the market when the price of an underlying asset moves contrary to indicator values. Divergences are a signal for price exhaustion in the market and usually serve as a precursor to potential trend reversals. A straight bullish divergence will occur when the asset price is making lower lows, but the RVI makes higher lows. This will be a signal that the price lacks ‘vigour’ and traders will look to place buy orders in anticipation of an upward price reversal.

Relative Volatility Index (RVI) – 2 Simple Trading Strategies

For example, if the https://traderoom.info/ is above 50 and the 50-period moving average is above the 100-period moving average, it could be a signal to enter a long position. Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market. Forex indicators actually take into account the price and volume of a particular trading instrument for further market forecasting. Technical indicators are used in forex technical analysis to aid traders and investors in making informed trading decisions. Indicators provide valuable information about the market trends, levels of support or resistance, and momentum that can help traders make better decisions on when to enter and exit their positions. When the momentum of a market is bullish, observe for higher closes.

By considering how this compares to the instrument’s recent price range, the RVI gives a normalised measure of the ‘oomph’ behind the move. This can help inform our opinion of how we expect the market to move going forward. This predictive ability means that the RVI is labelled as a leading indicator. It’s based on the principle that in a rising market, we expect the closing price to be on balance and in general, higher than the opening price. Similarly, in a falling market, we expect the closing price to be, more often than not, lower than the opening price.

What is a Forex Indicator?

As the world’s economy continues to ebb and flow, it’s no surprise that many traders feel hesitant to invest in the face of a possible recession. After all, the prospect of financial turmoil can be daunting… Calculate the RVI by applying a moving average (typically a 14-period) to the Relative Vigor.

Therefore, out of the five strategies, I would have to say the RVI with two moving averages is the best for day trading. The Slow Stochastic Oscillator is a momentum indicator that shows the location of the close relative to the high-low range over a set number of periods. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

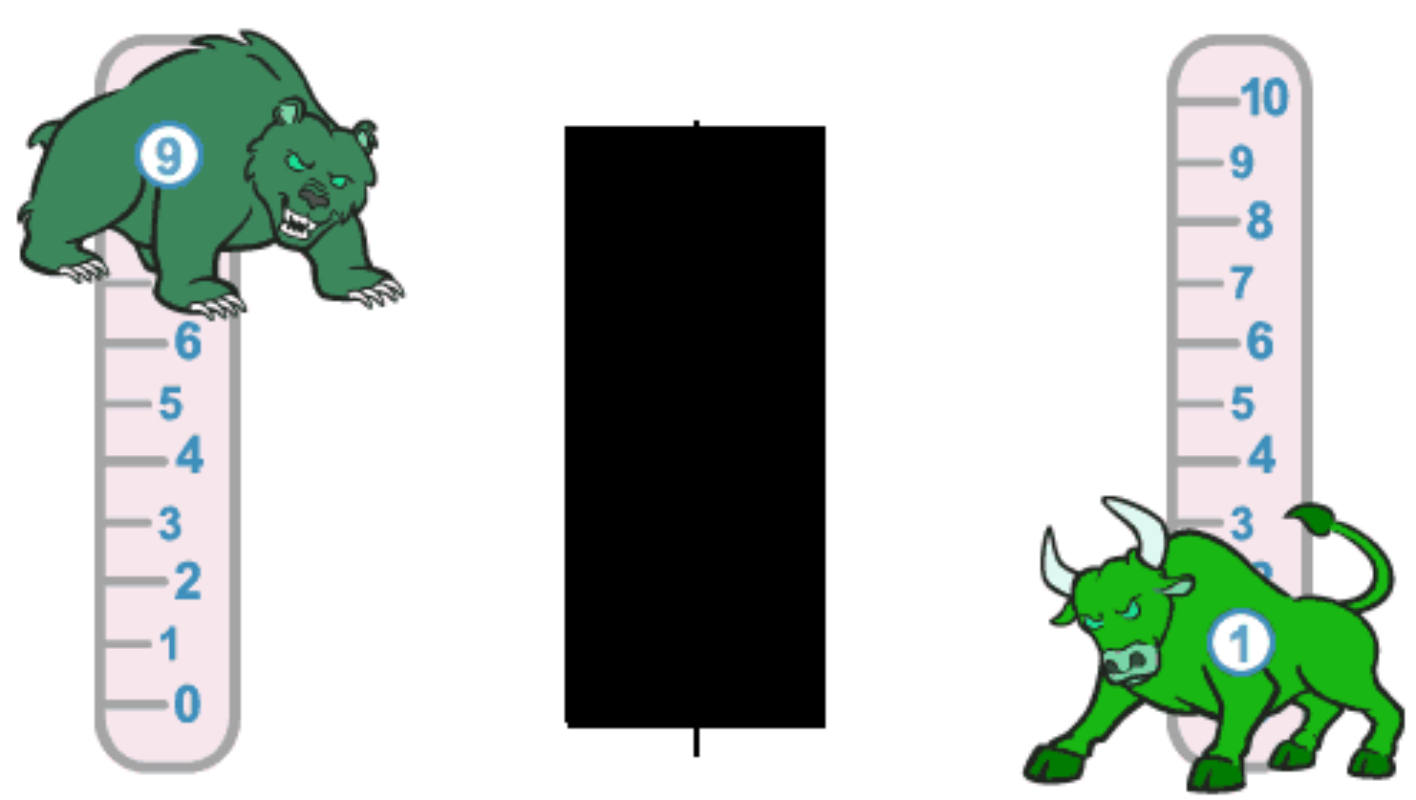

When in overbought conditions, the idea is to look for opportunities to place a short sale order. The signal to sell will be when the Green line crosses the Red line downwards. Likewise, the idea is to place buy orders when RVI is in oversold conditions. The signal to buy will be when the Green line crosses the Red line upwards. Momentum indicators such as the relative vigor index can be very useful indicators if used and interpreted correctly. These technical indicators can help to determine the current market conditions, including trends and ranges.

The https://forexdelta.net/ crossover is not much different from lines cross between two moving averages. These crossovers are designed to be leading indicators of future price direction. The RVI indicator is displayed on a price chart below the prices and consists of two lines. The first line is the actual RVI Indicator, and the second line is a signal line, which is slightly delayed and more smoothed. The easiest points to watch are where these two lines cross each other, which signals a change in the market from bullish to bearish sentiment and vice-versa.

RVI indicator – by default, the oscillator contains a red fast and a green slow line. The fast line shows the short-term balance of power in the market. A slow line signals the alignment of forces over longer periods of time.

Finally, we are returning and calling the function the store Apple’s Relative Vigor Index readings with 10 as the lookback period. AximDaily is considered a marketing publication and does not constitute investment advice or research. Its content represents the general views of our editors and does not consider individual readers’ personal circumstances, investment experience, or current financial situation.

- RVI Divergences and RVI Crossovers are the two most popular trading signals to use under the RVI indicator and are best used in analyzing data from trending markets.

- Overbought levels are used to signal opportunities to short or sell while oversold levels are used to signal opportunities to buy.

- When the trader has established a long position in an overall uptrend, he/she observes the RVI for bearish divergence from price.

- Forex technical analysis indicators are regularly used by traders to predict price movements in the Foreign Exchange market and thus increase the likelihood of making money in the Forex market.

A forex trading strategy designed to make maximum profits from a long-term uptrend can be created using the Relative Vigor Index in conjunction with other technical indicators. The RVI compares the closing price to price range and provides a reading of the strength of price movement up or down. Higher values for the RVI indicate increasing trend strength, while lower values indicate a lessening of momentum.